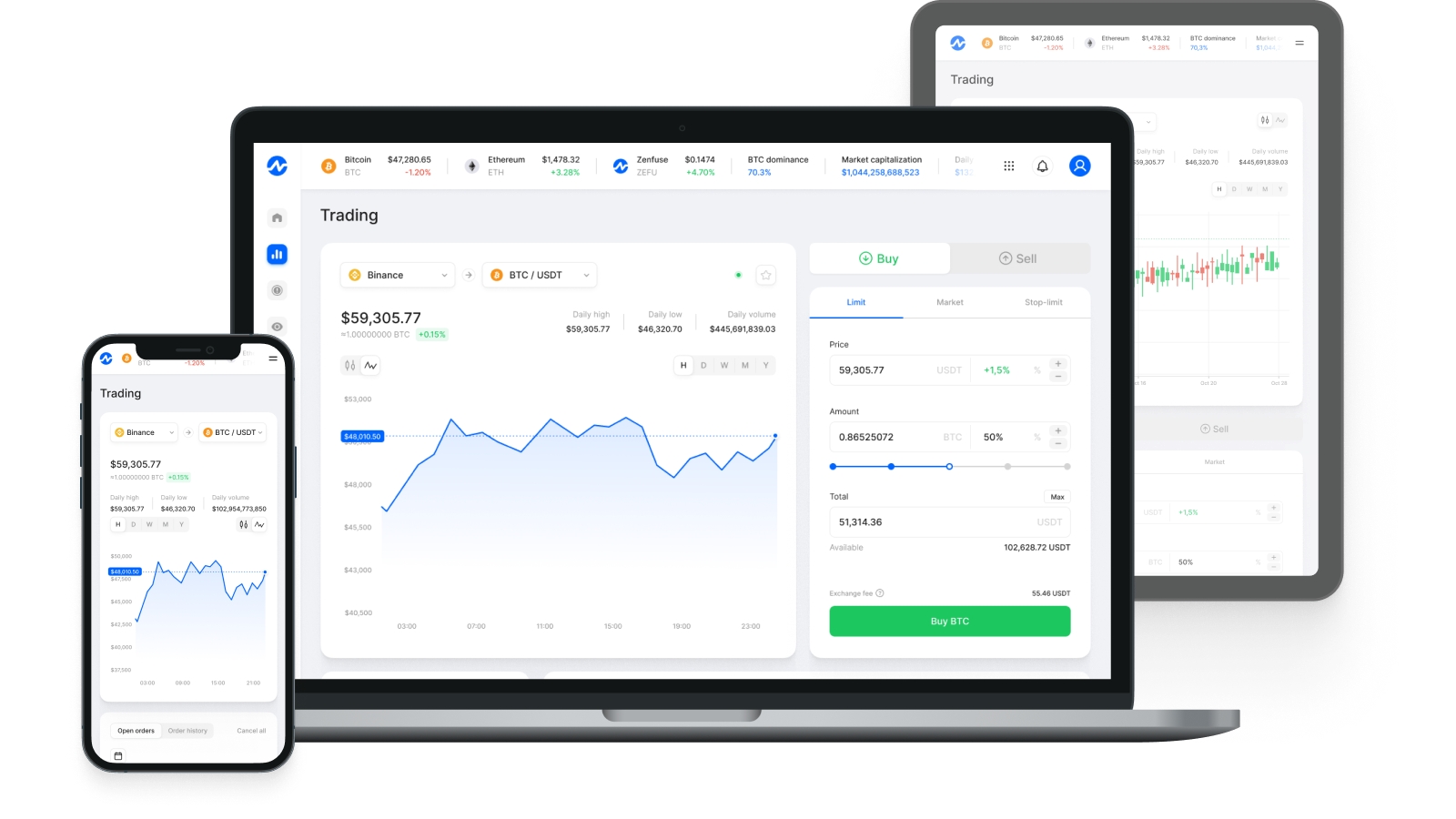

Trading

🙅♀️ Whole portfolio stop loss

Zenfuse will allow users to protect their funds via the setting of Whole Portfolio Stop Losses. This will be an exclusive function that automatically sells the user’s altcoins when specific conditions are met. For example, the user can set a Whole Portfolio Stop Loss to trigger when his whole portfolio goes down by 20% in BTC. Then, when a user’s portfolio moves from 10 BTC to 8 BTC, Zenfuse automatically sells all altcoins, protecting the user against future losses.

🤝 OCO orders

A One-Cancels-the-Other (OCO) order combines a limit order and a stop order in one action. When the price of an asset has reached a minimum, a stop order is executed, and the limit order is automatically canceled.

When the price of an asset reaches the maximum, a limit order is executed, and the stop order is automatically canceled. The user sets the minimum and maximum values. OCO orders are designed to mitigate risks and maximize profits for traders.

↔️ Scaled orders

Scaled orders are designed to help traders spend less time on trading. This powerful tool automatically creates multiple limit orders within a defined price range.

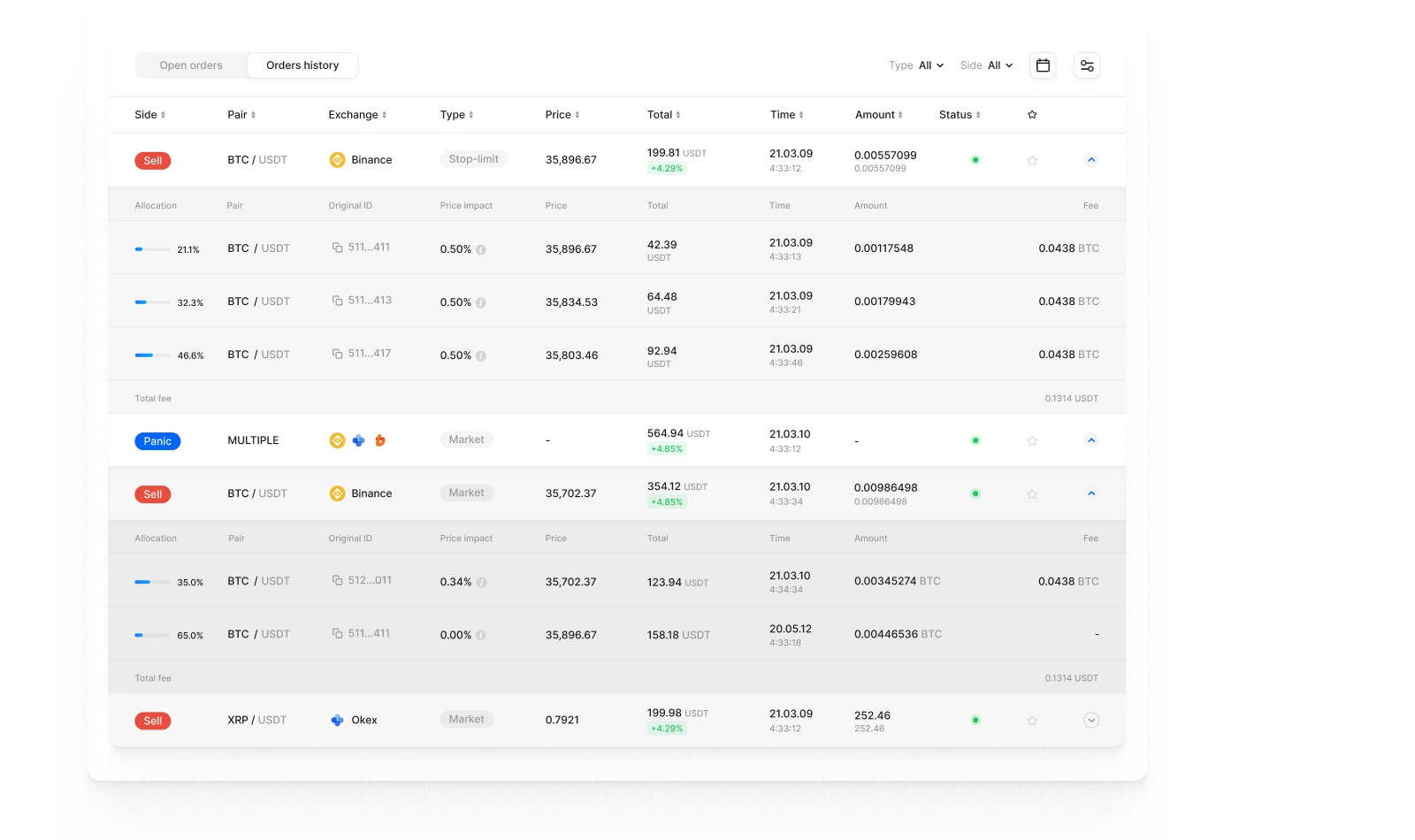

📔 Order history

This feature allows the user to analyze all orders from multiple exchanges, all in one place. Since Zenfuse tracks all trading activity for the user, researching their order history is simple and quick.

🙈 Hidden orders

Hidden orders are not visible in the order book. This type of order is helpful for those seeking to avoid influencing other traders with their orders.

Last updated